2024 Millage Rate Information

The Murray County Schools Board of Education plans to keep the Tax Millage Rate at 15.5 mills for 2024, the same rate we have maintained for the last 22 years.

Georgia law mandates a NOTICE OF PROPERTY TAX INCREASE if the proposed millage rate exceeds the calculated "rollback rate." However, the 2024 Tax Digest will generate less revenue than last year, meaning the "rollback rate" will not be exceeded. As a result, no public hearings are required.

Please find additional information below regarding the 2024 Tax Millage Rate.

Called Meeting Information

Date: August 22, 2024 at 6:00pm

Location: Murray County Board of Education - Board Room

Address: 1006 Green Rd, Chatsworth, GA 30705

Millage Rate FAQ's

20 Year Millage History

Digest Year | Millage Rate |

|---|---|

2005 | 15.5 |

2006 | 15.5 |

2007 | 15.5 |

2008 | 15.5 |

2009 | 15.5 |

2010 | 15.5 |

2011 | 15.5 |

2012 | 15.5 |

2013 | 15.5 |

2014 | 15.5 |

2015 | 15.5 |

2016 | 15.5 |

2017 | 15.5 |

2018 | 15.5 |

2019 | 15.5 |

2020 | 15.5 |

2021 | 15.5 |

2022 | 15.5 |

2023 | 15.5 |

2024 | 15.5 |

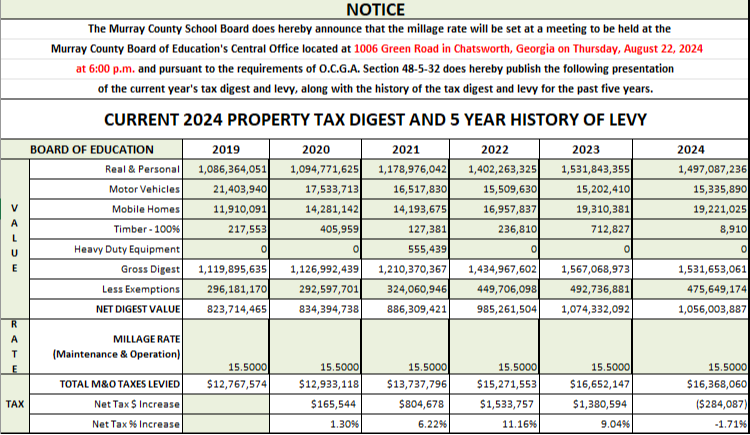

Current 2024 Property Tax Digest and 5 Year History of Levy

Examples:

Rate | Annual Tax | Monthly Tax |

|---|---|---|

$175,000 House with Homestead Exemption | ||

15.5 mills | $758.00 | $63.11 |

$125,000 House without Homestead Exemption | ||

15.5 mills | $557.00 | $46.40 |

*calculations are approximate